There are many factors to consider when you are budgeting for a new ride in Singapore. Did you know your total spending will exceed the cost of a car?

Before we begin, allow us to explain what COE and CEVS are.

Certificate of Entitlement (COE) is the document that you need to register for a new car. There are 5 CoE categories for different specifications:

Firstly, not everyone is entitled to a car just because you can afford it. You need to bid on a limited number of certificates and win it. Scarcity affects price, which could go higher than the cost of the car when demand is high. The latest COE premiums ended mostly higher among the five categories on Apr 6 in the latest bidding exercise.

To save you the hassle of bidding it yourself, dealers can also package your new car purchase together with the CoE.

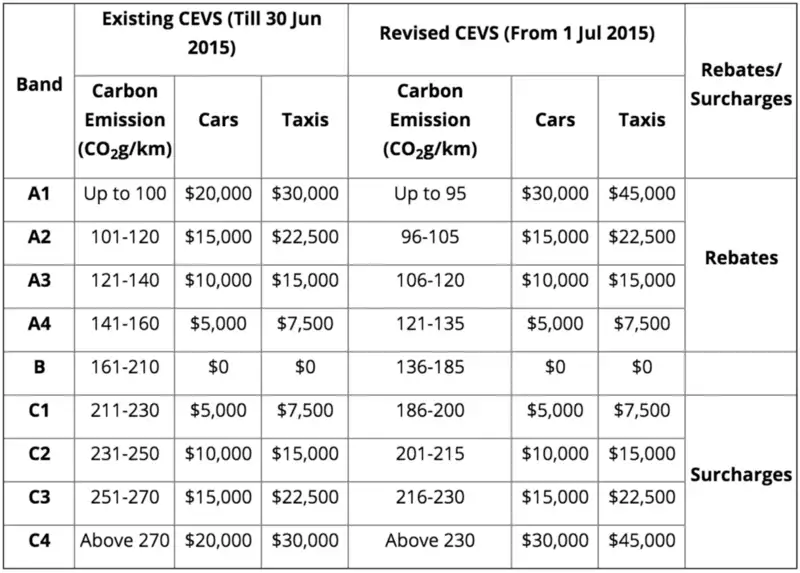

The carbon Emissions-Based Vehicle Scheme (CEVS) was introduced in Singapore to encourage the adoption of eco-friendly cars. Depending on your car’s carbon emission volume, you can either get a rebate or a surcharge, which can be viewed from the table below:

If you get a rebate, it will be in the form of an ARF rebate, which will reduce your PARF rebate, so it’s not exactly free dough. Additionally, CEVS is subjected to a minimum of S$5,000, so your ARF will not dip below 5,000 even if your CEVS is as high as a Rastafarian.

Interestingly, cars bought from Parallel Importers (PI) will usually have a high CEVS rebate. That’s because of the Evolution Coefficient (EC) rate, mandated by the Singapore government at 0.92. Essentially, you multiply the PI car’s carbon emission by the EC rate of 0.92, which results in a lower carbon emission figure and therefore, a higher CEVS rebate.

When a car’s Open Market Value (OMV) is S$20,000 or below, you are eligible for a loan of up to 60% of the car’s purchase price; 50% when it’s above S$20,000.

In other words, you can expect a minimum downpayment of either 40% or 50% of the car’s price depending on the OMV. CEVS and COE come in when you factor in the amount being loaned to you. You can allow your car dealer to handle the COE bidding process, which will cost in the COE value into your car loan.

If you do it yourself, you have to fork out the cash for COE. The car loan will then be calculated from the total price of the car without the COE cost. If a car is priced at S$50,000 and the COE cost is S$1,000, the car loan will instead be calculated based on S$49,000. Which means you have a choice of paying more in the beginning with lower monthly installments or pay less in the beginning and pay more for monthly payments.

COE cost will not be the only thing removed. Car loans will also consider all your eligible discounts before calculating the final amount, and that includes CEVS rebates. For better illustration, let’s consider these three hypothetical scenarios with the same hybrid car and calculate the loan amount:

Scenario A

OMV = $60,000

Selling Price = $100,000

CEVS Rebate = $15,000

Car Loan Amount = 50% X ($100,000u200a—u200a$15,000) = 50% X $85,000 = $42,500

Downpayment required = $42,500

In Scenario A, the downpayment required doesn’t include COE cost as you will be bidding yourself, so there’s no set amount that you’ll need to pay. However, that’s not to say that the COE is free, as you’ll need to pay out of your own pocket. As the car loan amount is 50%, you will have to pay the remaining 50% as a downpayment. If you allow the dealer to handle the COE bidding process, refer to scenario B.

Scenario B

OMV = $60,000

Selling Price = $100,000

CEVS Rebate = $15,000

Dealer’s COE Cost = $5,000

Car Loan Amount = 50% X ($100,000 + $5,000u200a—u200a$15,000) = 50% X $90,000 = $45,000

Downpayment required = $45,000

As the dealer is handling the COE bidding, the amount being loaned to you and the amount you need to pay for a downpayment will increase. The good news is that you don’t have to pay a lot out of your pocket, since the COE bidding costs will be included in the loan but the downside is that you have to pay more every month for installments.

If you have no discounts or rebates, and you choose to let the dealer handle your COE bidding, refer to scenario C:

Scenario C

OMV = $60,000

Selling Price = $100,000

CEVS Rebate = 0

Dealer’s CoE Cost = $5,000

Car Loan Amount = 50% X ($100,000 + $5,000) = 50% X $105,000 = $52,500

Downpayment required = $52,500

In scenario C, there are no discounts, and you let the dealer handle your COE bid, which translates to a higher downpayment and higher loan amount. Of course, you’ll have to factor in the interest rate to truly know how much you have to pay every month but these figures were made to simplify your calculations.

Clearly, there’s a lot of math in budgeting for cars but it’s not all that confusing. Just remember that an OMV that is higher than S$20,000 is eligible for a 50% loan while anything less than that is eligible for a 60% loan. If you want to get higher CEVS rebates, go for a more eco-friendly car. It doesn’t have to be a hybrid.

PS: CEVS can either be a rebate or a surcharge, so if you’re using a car with high carbon emissions, you’re going to be losing more of those precious dollars.

If you’re not thinking of getting a new car, used cars are becoming a more attractive proposition if you’re looking for an affordable ride. Should you buy it or not? We work out the good and bad points so you can decide better.

Compare the cheapest car insurance on GoBear Singapore

This blog was first published on carsomesg.com, a smarter, easier car buying, and selling platform, aiming to provide you with hassle & haggle-free experience when it comes to purchasing or selling a car.

This article was first published on GoBear Singapore blog.