All geared up and ready to start your first trip as a Grab driver? The sheer excitement of being your own boss and deciding how you want to earn your keep is understandable.

But before all that sinks in, have a think about protecting yourself from unexpected situations. On the legal front, you need to have suitable car insurance, which can be either third-party or comprehensive, regardless if you’re driving for yourself or as a Grab driver.

While the key considerations for your commercial car insurance stay the same, there are a few other factors that you’ll also need to consider. But with so much to consider, what are the key points that will help you decide which commercial car insurance is the right one for you?

No-claim discount protection

Most insurers provide up to 50% no-claim discount (NCD), which directly makes your premium more affordable. Look for additional perks such as guaranteed lifetime NCD with FWD Insurance (FWD) upon reaching 50% at no additional cost.

What’s covered

Loss or damage to car / Death or injury to a third-party / Damage to third-party property.

Workshop

Check the approved list of workshops from your insurer, and whether it also gives you the option to send your car to your personal workshop. Some insurers go the extra mile to guarantee your repairs are protected against defective workmanship. For example, FWD’s extended workmanship guarantee will ensure the repairs done at FWD’s Premium Workshops are up to standard. This guarantee applies until your car reaches 10 years of age from its original registration date.

Income replacement

Some insurers will include income replacement when your car is being repaired. Do check the daily rate and number of days or amount of money that it’s capped at.

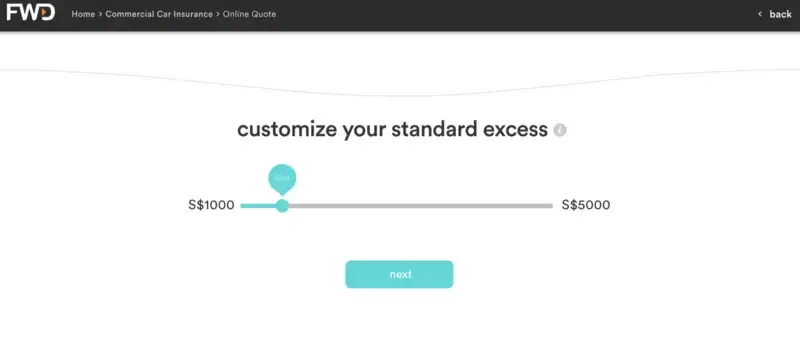

Adjustable excess

Depending on how much excess you are willing to pay, your premium can be adjusted to fit your budget. Insurers such as FWD has an intuitive online interface to find the right balance between your premium and excess amount.

Makes sense, doesn’t it? If you’ve worked so hard to be accident-free for the last five years to attain a 50% NCD, insuring your NCD is beneficial in the long run.

Most insurers have the option to protect your NCD, allowing you to retain your NCD even if you were determined to be at fault and had to make a claim.

This, however, applies only for the first time you’ve claimed in that year, so you’ll still need to take due caution to maintain your NCD.

What happens when you reach the maximum 50% NCD? Hold onto it for dear life. Protect it at all costs.

Now, how many insurers will guarantee you a lifetime 50% NCD at no additional cost? FWD does, and on top of that, if you have a clean driving record, there’s another 5% discount on your premium.

Promo alert

Having a lifetime 50% NCD is just one of the many benefits you get with FWD Insurance. From time to time, the insurer has attractive promotions for their commercial car insurance plans.

If you intend to purchase one anytime soon, have a quick look at FWD’s website to see what’s the current promotion. For all you know, you might be paying even less than you expected for your annual premium.

One of the top concerns for drivers, regardless if you are driving for personal reasons or on the road as a private-hire driver, is the coverage afforded by the commercial car insurance.

While most insurers will cover the basics, be doubly sure that the following are covered:

As for how much it covers, this is highly dependent on the insurer. For the most part, you should ensure that your third-party liability is well-covered. This is crucial to protect yourself from an unexpected claim by the third-party.

For example, FWD’s maximum benefit for death or injury to a third-party has no limit, while the property is covered up to $5,000,000.

Do lookout for the bells and whistles in your commercial car insurance plan, such as coverage for your car accessories. For one, this will ensure your in-car recorder, which has become a basic necessity, is covered and the amount you recover can be used to purchase a new one.

Just like your health, a car is a very personal object that requires a trusted person to look after it and fix all the problems. Before you commit to commercial car insurance, have a look at the workshops on its approved list.

Are the approved workshops trustworthy? Definitely. Workshops listed under an insurer’s approved list has one huge advantageu200a—u200athe workmanship quality is guaranteed.

If by some chance, the workshop doesn’t carry out a satisfactory repair, insurers such as FWD have an extended workmanship guarantee. This guarantee, which lasts till your car turns 10 from its original registration date, ensures your car is restored and ready for the road.

But like we said, a car is a very personal item. If you prefer to send your car to your personal workshop for repairs, most insurers will allow you to do so, with a slight top-up to the premium.

For personal vehicles, insurers will either provide you with a daily transport allowance or replacement car. But in the case of commercial cars, you are compensated in the form of an income replacement. Do check the fine print and see how much you’re getting as there will be a limit on the amount and number of days.

Speaking of premium, no one likes to pay more than they should for the premium. This holds true for commercial car insurance. While the NCD can shave a significant amount off your cost, you’ll also have to figure out how much you’re willing to fork out for the excess.

Take a Kia Cerato 1.6 registered in 2010 as an example. With a 50% NCD and an additional 5% discount for being a demerit-free driver, you can expect to pay for a comprehensive plan between $1,000 to $1,700 depending on the amount of excess.

The bigger question isu200a—u200ais a $700 saving in the premium worth the risk of paying much more for your excess? Balancing the perfect excess versus premium will take quite a bit of work.

Often, insurers will be going back and forth with you to decide on the best ratio. But you have the option to do this on your own free time with FWD’s intuitive online quote and use the slider to determine the premium cost for a comfortable excess level. In fact, you could be looking at a premium that costs as low as $82 per month.

Yes, we’re not kidding. You can see it for yourself at FWD and find the best excess to premium ratio to keep the cost manageable.

On top of that, you might also score additional discounts with ongoing promotions that are listed on FWD’s website.

This article is created in collaboration with FWD to help Grab drivers ease their search for the right commercial car insurance.

This article was first published on GoBear Singapore blog.