Singapore’s healthcare system is one of the best in the world, ranking 6th best globally according to the World Health Organization (WHO). While that’s great news for ex-pats living in the Lion City, it comes with a caveat: Healthcare in Singapore is expensive.

In 2018, Singapore’s healthcare costs inflated by 10%, which is ten times the economic inflation rate. And for those who are looking to spend their retirement years in the country, elderly healthcare costs in Singapore are projected to rise tenfold over the next 15 years.

Public healthcare is subsidized by the government, but this benefit only applies to citizens and ex-pats that have achieved permanent resident (PR) status since they make Central Provide Fund (CPF) contributions. Non-PRs don’t have to make CPF contributions, but that means they have to be intentional about their healthcare coverage.

Non-PR ex-pats can choose to pay out-of-pocket or invest in a health insurance plan to cover their medical needs.

Considering the prices, it’s a no-brainer for ex-pats to invest in health insurance. Not only will it protect them from medical emergencies, but it will also shield them from the high costs associated with healthcare in Singapore.

Find out information about:-

Now, there are several types of health insurance available in the market. We’re going to focus on local versus international coverage:

If you’re working for a Singapore-based company, it’s likely you’re already receiving medical benefits from your employer. More often than not, these plans offer basic coverage and are not equipped to protect you from pre-existing conditions or medical benefits outside of Singapore.

It’s best to double-check the benefits you already have so you can see where you’ll need to fill in the gaps with supplementary insurance.

Meanwhile, there are few differences between choosing a local and foreign insurance provider. They may differ in their network of hospitals and clinics, but the perk of going with a local provider is they’re easier to get in touch with since they have offices in Singapore.

Singaporeans might find local coverage to be enough, but for ex-pats, the situation is quite different.

Local coverage is meant to be used only in Singapore. Some plans will offer some form of overseas coverage, but the benefits are limited and usually only valid in emergency situations. And while some plans can immediately subsidize any emergency treatments, there may be some cases where you’ll have to pay out of pocket, especially if it’s at a non-accredited hospital or clinic.

Not to mention local insurance or IPs now have a compulsory 5% co-payment as mandated by the government in an effort to curb overconsumption of healthcare services.

While international coverage will inevitably be more expensive, it can provide you with worldwide coverage (sans certain countries or regions depending on the plan and provider) where you receive the same benefits in any of the listed countries.

Take note that most international coverage excludes the US as medical costs here are particularly high.

You can also add-on a number of benefits to better meet your needs, such as:

Note that these are add-ons and will incur additional costs to your plan.

International health insurance is best if you take frequent trips home and stay there for extended periods, you frequently travel whether for work or leisure, or you decide to relocate to another country at some point in time. It’s also useful if you have a very specific condition that’s best treated elsewhereu200a—u200ainternational health insurance can cover your medical tourism fees.

See more: Best international health insurance Singapore 2020

The cost of health insurance is highly dependent on a number of variables:

Certain health insurance providers may put premiums on their plans because of their reputation or their network of clinics or hospitals too.

To determine the costs, we’ll use GoBear’s comparison platform to gauge some of the average prices. Let’s say you’re a 35-year old male who’s only looking for hospitalization coverage for yourselfu200a—u200athis is the most basic plan you can get.

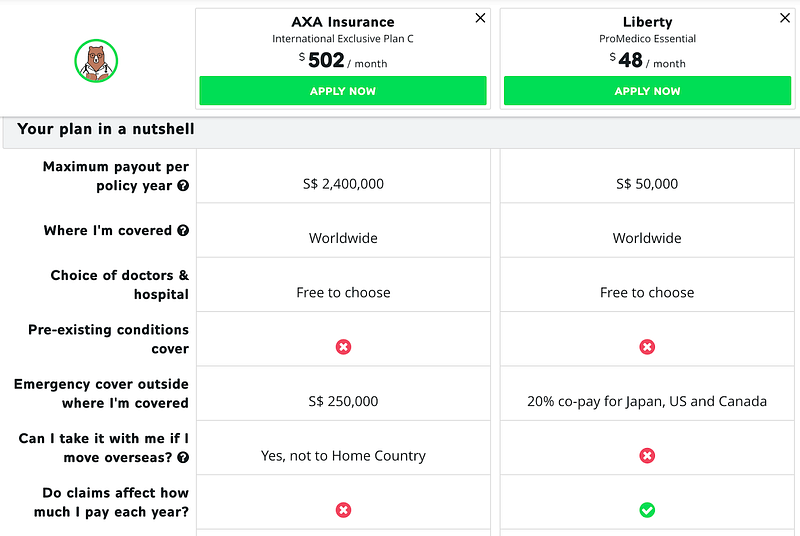

The cheapest international insurance you can get is at S$48 per month where you get a maximum payout of S$50,000 per policy year. Meanwhile, the most expensive basic plan you can get is S$502 per month, which includes a maximum payout of S$2,400,000 per policy year.

The more expensive plan also offers up to S$250,000 for medical emergencies outside of coverage areas (the cheaper plan only offers 20% copayment in three select countries) and allows you to carry your insurance over when you relocate to another country.

It’s a classic case of “you get what you pay for.” While you’re definitely saving with the S$48 dollar per month plan, you’ll only be able to avail of medical care amounting to S$50,000u200a—u200aanything more than that and you’ll have to shell out yourself, keeping in mind the cost of a heart bypass alone can go up to half your annual payout.

Co-payments, riders, payouts —alternative health insurance is filled with tons of jargon that can be confusing at first. But to determine the plan that suits your needs, you need to focus on the following:

With all that said, the more comprehensive your insurance policy, the higher the cost. Keep in mind that bigger isn’t always betteru200a—u200ayou need to determine your needs to find the perfect plan for you, and that will naturally require a lot of research.

This article was first published on GoBear Singapore blog.