For ex-pats, working in Singapore is a nice change of pace. The weather is always warm and sunny, the food is good, and the opportunities are endless.

However, living in a foreign country does come with its own set of responsibilitiesu200a—u200ahealth insurance being one of them.

Healthcare in Singapore is not cheap. Being a foreigner in Singapore means that you don’t enjoy schemes such as local “social security” or Medishield, as these benefits are exclusive to Singapore citizens and permanent residents (PRs). Certain healthcare facilities in the country also offer two ratesu200a—u200aone for citizens and PRs and one for foreignersu200a—u200aand the latter is usually higher.

Meanwhile, private healthcare tends to be more expensive than public healthcare, depending on the size and location of the hospital or clinic you visit. For example, based on the Ministry of Health’s fee benchmark, the total cost of an ankle joint fracture re-alignment in a c-class public hospital ward would cost you around S$8,095 without subsidy. In comparison, it would cost you close to $19,058 at a private hospital.

Even if public clinics and hospitals are accessible to you, there are some scenarios where you might prefer to seek medical treatment at a private facility, considering the waits are shorter and there are more private wards available. Some public hospitals have so many patients that people end up waiting in line for hours before they get admitted. One hospital saw an average wait time of over five hours.

These are some of the reasons why ex-pats in Singapore tend to buy private health insurance to protect themselves from the rising healthcare costs in the country. But is there any reason for ex-pats to consider health insurance as opposed to cheaper local insurance?

Let’s explore the scenarios where international health insurance may be the better option.

When it comes to health insurance, you can choose between health insurance with local coverage and health insurance with international coverage.

The main difference between these is the area of coverageu200a—u200alocal coverage will only subsidize medical care sought within Singapore, while international coverage will subsidize medical care in any of the listed countries (depending on your plan).

International health insurance is ideal for ex-pats in Singapore who need comprehensive medical care in different countries. For instance, if you travel a lot for work or if you tend to go back and forth between Singapore and your home country in long intervals. International health insurance saves you the trouble of having to buy multiple health insurance policies in different countries.

International health insurance also tends to have higher annual limits and options for emergency evacuation and repatriation coverage, if you need medical care in your home country. You can enjoy an easier claims process for treatments in a foreign country as well, as local plans usually have a lot of restrictions with regard to medical facilities that can be used to file a claim.

And if you ever decide to move back home or live in a foreign country, you can usually take your health insurance with you.

Now, that sounds all well and good, but it’s time to address the elephant in the room: the price tag.

Just how much more does international health insurance cost?

The cost of health insurance depends on a number of factors:

See more: The all-in-one guide to health insurance for ex-pats in Singapore

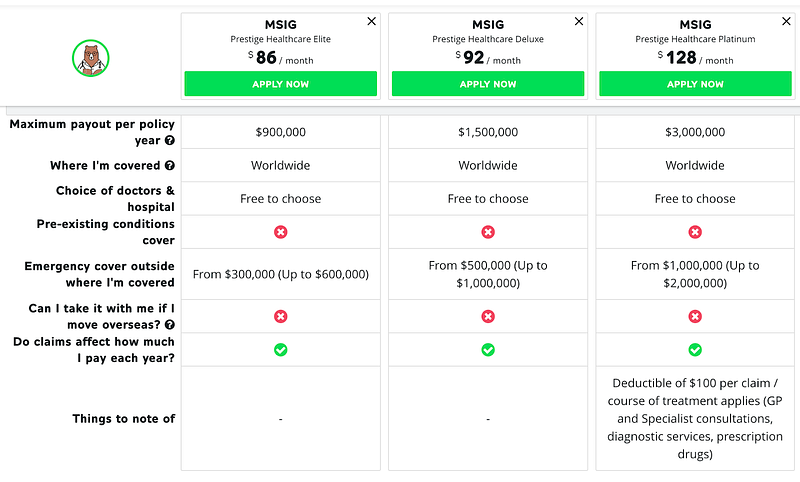

Let’s say you’re a healthy 35-year old male looking for health insurance, using GoBear’s comparison platform let’s take a look at three different plans offered by MSIG Insurance:

As you can see, the difference between these plans is not that big. Each of them can give you worldwide coverage, and you’re free to choose your doctor and hospital. Their coverage even includes the US, which is usually excluded in international health insurance plans due to the country’s high medical costs. The only difference is your claim limit.

If you add an additional S$42 per month to the cheapest plan then you’ve got yourself three times the payout per policy year.

Take note that none of these plans covers repatriation, meaning you can’t take your policy with you if you choose to move out of Singapore. They also don’t cover pre-existing conditions, which may be useful depending on your health. But considering the price point, you can simply purchase add-ons or riders that can give you any of these additional benefits to customize your policy to best fit your needs.

With all that said, this is not to say that the more expensive health insurance plan is necessarily better. There is no “one-size-fits-all” plan and it is ideal to pick the plan that best meets your personal needs.

This article was first published on GoBear Singapore blog.